Risk Warning: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite.

Swap Rates

Competitive Swap rates

Transparent Swap Rates

No hidden fees

Following current interest rates

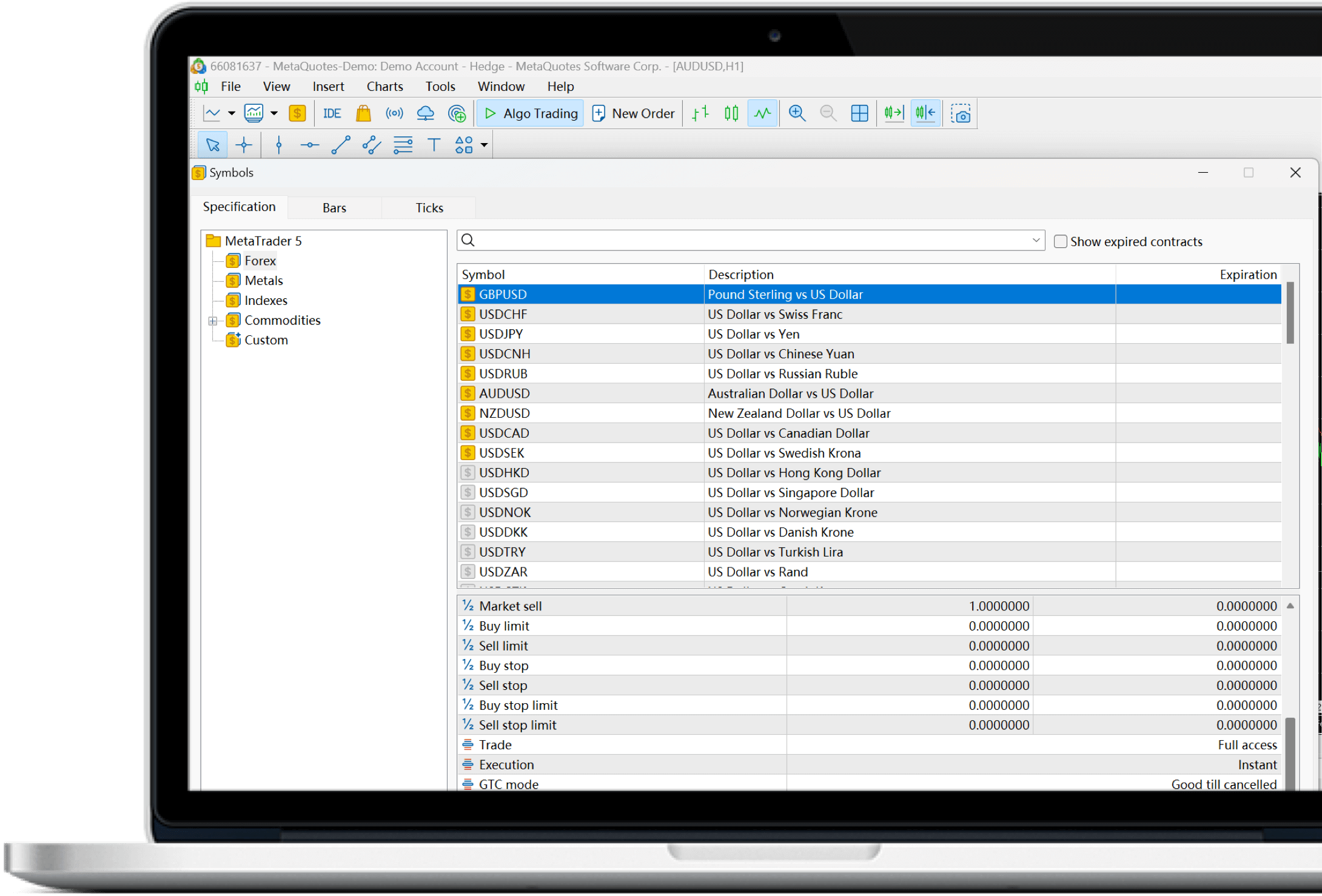

How to Find AAA Trading Markets’Swap Rates in MT5?

To check the latest rates on MT5 accounts:

· Go to “Market Watch” section

· Right-click to select “Symbols”

·Choose the forex pair you want to trade

· Click on the “Properties” for the pair, (on MT5, please select 'Specification')

· All the information on the pair, such as forex swap rate, stop level, initial margin and more, will be displayed

Swap list

- Symblol

- Description

- Long Swaps Value (points)*

- Short Swap Value (Points)*

- AUDUSD

- Australian Dollar vs US Dollar

- -4.095

- 0.828

- EURUSD

- Euro vs US Dollar

- -12.887

- 6.737

- GBPUSD

- Great British Pound vs US Dollar

- -10.119

- 4.207

- NZDUSD

- New Zealand Dollar vs US Dollar

- -3.74

- 0.445

- USDCAD

- US Dollar vs Canadian Dollar

- -2.333

- -9.277

- USDCHF

- US Dollar vs Swiss Franc

- 6.441

- -12.686

- USDJPY

- US Dollar vs Japanese Yen

- 7.361

- -13.773

- AUDCAD

- Australian Dollar vs Canadian Dollar

- -1.682

- -3.453

- AUDCHF

- Australian Dollar vs Swiss Franc

- 1.914

- -7.23

- AUDJPY

- Australian Dollar vs Japanese Yen

- 2.564

- -7.316

- AUDNZD

- Australian Dollar vs New Zealand Dollar

- -5.859

- -4.902

- CADCHF

- Canadian Dollar vs Swiss Franc

- 0.482

- -8.294

- CADJPY

- Canadian Dollar vs Japanese Yen

- 2.078

- -7.223

- CHFJPY

- Swiss Franc vs Japanese Yen

- -3.209

- -2.991

- EURAUD

- Euro vs Australian Dollar

- -13.3.6

- 3.799

- EURCAD

- Euro vs Canadian Dollar

- -12.133

- 1.301

- EURCHF

- Euro vs Swiss Franc

- -1.63

- -4.6

- EURGBP

- Euro vs Great British Pound

- -4.879

- 0.889

- EURJPY

- Euro vs Japanese Yen

- -1.045

- -4.118

- EURNZD

- Euro vs New Zealand Dollar

- -20.054

- 0.062

- GBPAUD

- Great British Pound vs Australian Dollar

- -8.378

- -0.367

- GBPCAD

- Great British Pound vs Canadian Dollar

- -6.273

- -2.166

- GBPCHF

- Great British Pound vs Swiss Franc

- -6.273

- -2.166

- GBPJPY

- Great British Pound vs Japanese Yen

- 2.277

- -9.955

- GBPNZD

- Great British Pound vs New Zealand Dollar

- -9.996

- -5.036

- NZDCAD

- New Zealand Dollar vs Canadian Dollar

- -4.137

- -6.447

- NZDCHF

- New Zealand Dollar vs Swiss Franc

- 0.685

- -8.733

- NZDJPY

- New Zealand Dollar vs Japanese Yen

- 0.661

- -9.423

- USDCNH

- US Dollar vs Chinese Yuan in Hongkong Spot

- -47.531

- -111.331

- USDHKD

- US Dollar vs Hong Kong Dollar Spot

- -47.531

- -111.131

- USDNOK

- US Dollar vs Norwegian Krona Spot

- -10.823

- -90.013

- USDPLN

- US Dollar vs Polish Zloty Spot

- -27.819

- -50.039

- USDSEK

- US Dollar vs Swedish Krone Spot

- -13.607

- -182.897

- USDSGD

- US Dollar vs Singapore Dollar Spot

- -13.145

- -16.005

- USDTRY

- US Dollar vs Turkish Lira Spot

- -500.764

- 214.524

- USDZAR

- US Dollar vs South African Rand Spot

- -297.66

- 60.3